The graphically named “gut strangle” is a seldom-used strategy, but it might work in some circumstances. This involves trading in-the-money calls and puts. A long gut strangle is set up by buying both options; and a short gut strangle calls for selling both sides.

This approach will work if you believe that profits will accumulate when you work with in-the-money positions rather than at- or out-of-the-money ones. For most traders, this long shot keeps them away from the “guts” and sets up a preference for the less expensive long or less risky short forms of strangles.

These can be opened in either configuration whether you own stock or just want to work with options.

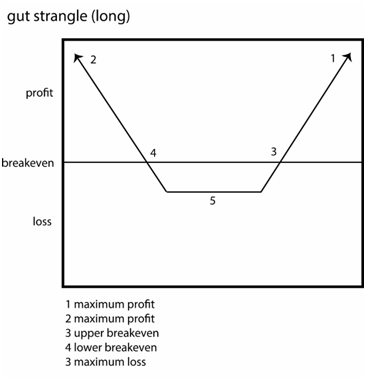

Gut strangle (long)

A long gut strangle is the purchase of an ITM call and an ITM put. The idea is that either side needs to move enough points to exceed the cost of the options.

It is typically opened when you expect a big move but you’re not certain of the direction. For example, a stock tending to move a lot after earnings surprises may jump higher or fall lower, and a surprise is expected. The long gut strangle is a gamble because you will need many points of movement, but it also can pay off in a big way if the move takes place.

This sets up unlimited profit potential along with limited risk. A profit occurs when price moves more than the total cost to open the position:

Underlying long call strike – net premium paid

The gut strangle will break even in two circumstances:

Net premium paid + long call strike

Strike of long put – net premium paid

The risk in the long gut spread is limited. It occurs when the underlying price ends up in between the two strikes:

Net premium paid + strike of long put – strike of long call

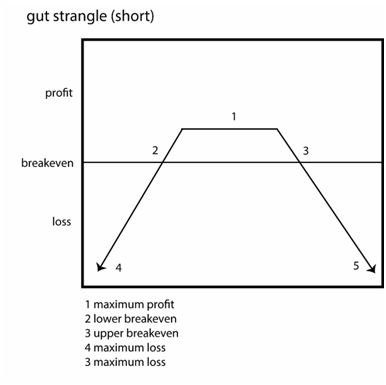

Gut strangle (short)

A short position is set up by selling a call and a put, both in the money.

This version establishes limited profit with unlimited risk. It is the opposite of the long guts because both profit and loss are flipped.

With the sale, you receive the net premium for the two in-the-money options. This is the appeal of the short gut strangle. However, you also have to ensure that collateral is posted in your margin account for both options. Depending on the strike, this could be an inhibiting number.

The short gut strangle is an oddity. The short put has the same market risk as a covered call, but the short call is a high-risk position. It combines low-risk and high-risk in a single strategy.

The limited profit is equal to the net premium received, and it occurs when the underlying ends up in between the two strikes:

Net premium received + short put strike – short call strike

Breakeven occurs in two positions:

Net premium received + strike of short call

Strike of short put – net premium received

Maximum risk can be substantial and is unlimited. It occurs whenever the underlying moves above or below the strikes and exceeds premium received:

Price of underlying

Price of underlying > strike of short call + net premium received

This can be modified away from the strangle and set up as a straddle, but more important than this is the analysis of potential profit or loss overall. The gut strangle is rarely employed because profits are difficult to earn and risks are difficult to overcome. Even so, it deserves consideration in the range of possible options strategies you could deploy.

Michael C. Thomsett is a widely published author with over 80 business and investing books, including the best-selling Getting Started in Options , coming out in its 10th edition later this year. He also wrote the recently released The Mathematics of Options . Thomsett is a frequent speaker at trade shows and blogs on his website at Thomsett Guide as well as on Seeking Alpha, LinkedIn, Twitter and Facebook.

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: