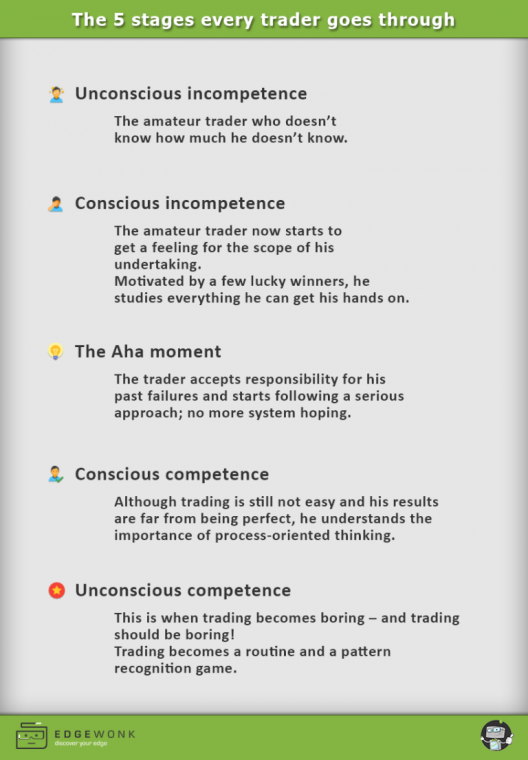

There are 5 stages every trader will go through over the years. You can’t skip one and knowing which one you are in and being totally honest with yourself is essential. Excellent post from our friends at Tradeciety. Which stage are you at right now? Try to answer this question as best and honest as you can.

Unconscious incompetence

This is the initial phase of a new trader when he is just getting his feet wet in the markets and looks at his trading platform for the first time. At that stage, a trader doesn’t know how much he doesn’t know, which can often be a liberating, but dangerous place to be in.

His trading decisions are pretty much still a gamble and not backed by a sophisticated decision-making process; although the unconscious incompetent trader will never admit that – he doesn’t know any better yet.

A few characteristics of the unconscious incompetent trader:

- He randomly opens and exits trades without a defined trading system

- He changes his “approach” on a trade to trade basis

- He does not apply risk management or position sizing principles

- He often changes his trade direction on the spot and chases price

- He gets motivated by winning trades and does not care much about losses

- Beginners luck is what keeps him going

- One loss often wipes out all previous wins

At this stage, the traders with beginners luck are more likely to keep going and make it to the next stage. Often, however, traders lose money, get easily discouraged and acknowledge that trading isn’t as easy as clicking a mouse.

Conscious incompetence

Now it dawns on the trader how little he knows and he starts to understand that he has to put in the work and study more. Motivated by a few lucky winners, he studies everything he can get his hands on.

A trader who still loses money consistently, even after spending a lot of time learning about trading, will often start blaming his tools, the wrong indicators, missing information or unfair markets; he is looking for external excuses.

This stage of conscious incompetence is the one that lasts the longest. Some traders will never leave this stage, even after years of being involved in the markets. A few principles and questions can make you aware of potential problems in your trading mindset and general approach:

- Have I changed my trading system more than once in the last 6 months without really putting in the work?

- Am I actively reviewing my trades to find out what is going wrong?

- Am I still making impulsive trading mistakes that cost a lot of money?

- Do I repeat the same trading mistakes over and over again?

Sit down and try to answer these questions. Be honest with yourself even if the truth hurts. Lying to yourself will keep you trapped in your current state and you won’t be able to improve and evolve as a trader.

The Aha moment

It sounds cliché but this is the time when the trader accepts responsibility for his actions. He understands that all his past mistakes and false behavior will not get him anywhere. If a trader is really serious about making this work, there is typically only one way and the following principles describe the “new” mindset:

- He stops changing systems and focuses on making the one he has work

- He starts monitoring his behavior to find negative behavioral patterns

- He follows a daily trading routine, starts keeping a trading plan and a trading journal

- He understands that entries are just one part of his system and that, in order to become profitable, he has to work on all components of his system

Conscious competence

The trader now starts to realize what trading is all about. Although trading is still not easy and his results are far from being perfect, he understands the importance of process-oriented thinking. He stops focusing on only the outcome of his trades.

Traders at this stage are typically break-even traders and slowly start to turn their equity graph up. Discipline, emotions and adequate risk management are of utmost importance at this stage and a long-term approach will keep the trader from falling back into old habits.

The trading journal becomes his most important companion at this stage because it provides an objective look at his performance and behavior. Traders at this stage are very likely to make it to the next and final stage. They can see that their work is starting to pay off, they stop system hopping and focus on their process-oiented approach.

Unconscious competence

This is when trading becomes boring – and trading should be boring! At this stage, the trader has spent years of looking at screens and taking the same setups hundreds or even thousands of times. He knows exactly how his preferred setup looks like and trading becomes a waiting game.

At this stage, the trader has fully internalized that he can’t win every trade and, more importantly, he does not really care about losses as long as he has followed his rules. Trading is now an activity of pattern recognition, risk management and constant self-improvement.

The unconscious competent trader has a thirst for self-improvement and constantly studies the markets. He evaluates the effectiveness of his method and he is driven by the success and his improvements so far.

Which stage are you at right now?

Being a trader is a life-long journey of self-improvement and self-discovery. The markets teach you something about yourself every day. In fact, a trading plan that makes money for a trader is simply the extension of his own personality with all its qualities and imperfections.

Your task right now – if you are not a consistently profitable trader yet – is to sit down and take a deep look at yourself. Then try to answer the following question: which stage are you at right now?

Try to answer this question as best and honest as you can. The moment you answer this question, and draw the consequences from it, you will be on your path to improving your trading bit by bit until one day you will finally reach controlled profitability.

This article has been published originally on Edgewonk.com – Tradeciety’s partner site: original article here.

If you are ready to start your journey AND make a long term commitment to be a student of the markets:

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease:

Saturday, December 15, 2018