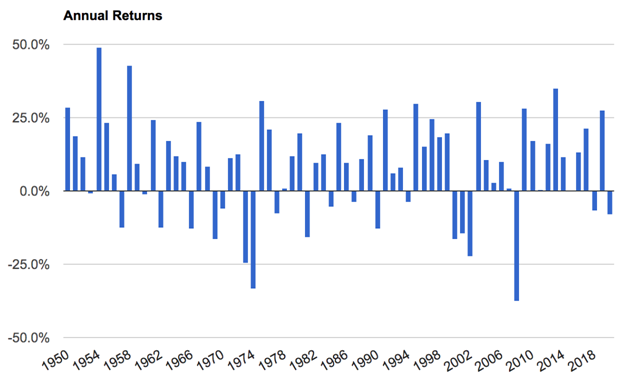

From 1950-2019, the average annual US equity market premium (return of the total stock market minus the return of one-month US Treasury Bills) was 8.37% per year. This was a large average annual risk premium for owning stocks. The premium was volatile, with a Standard Deviation of approximately 15% per year.

The below chart illustrates the wide range of one-year outcomes. Investors should attempt to truly internalize the emotions they are likely to feel with this type of very normal and expected volatility associated with equity investing. Euphoria when volatility results in above average premiums and despair when volatility results in substantially negative premiums.

There has historically been about one third of all years where the equity premium was negative (the equity market underperformed T-bills), and sometimes by substantial amounts where an investor would have experienced significant short-term capital losses taking several years to recover. Even at a 10-year time horizon, the historical frequency of a market portfolio of US stocks outperforming riskless T-bills has not been guaranteed, with approximately 15% of periods resulting in a negative equity premium. 15% of historical 10-year periods would have resulted in a time of reflection where you realized you took risk for an entire decade without receiving a reward relative to leaving your capital in the safety of T-bills, which are a proxy for cash/money market.

Over time an investment in the total US equity market is expected to provide investors with a return that is many multiples of an investment in risk-free T-bills, otherwise investors would not take on the risk. Diversifying globally further increases these odds, but it’s never a guarantee so investors should come to peace with this uncertainty in order to make better informed investment decisions.

Choice #1: Resist the lessons available within the historical data and endlessly pursue the hope of finding someone or something that can remove the risk of the equity market without also at the same time removing the return.

Choice #2: Come to peace with the historical data, knowing the odds of earning the expected equity premium improve as your time horizon increases, and build a financial plan that accounts for the probabilities.

I believe the second choice is the more likely path towards a long-term successful investment experience as the historical evidence against active portfolio management is overwhelming to the point to where it's imprudent to even try. This is a market-based approach where an investor focuses on what they can control, such as minimizing costs & taxes and thinking through proper asset allocation between stocks, bonds, and cash suitable for their situation. At the same time an informed investor knows how volatile the equity premium can be and is less likely to panic sell when it’s negative for a long period of time. Surprise is often the mother of panic, so it’s best to become a student of history so that you’re not surprised when the risk shows up. Harry Truman said "The only thing new in the world is the history you don’t know.”

In an excellent piece available upon request titled “The Happiness Equation”, Brad Steiman of Dimensional Fund Advisors writes “Ancient wisdom teaches acceptance, as resistance often fuels anxiety. Instead of resisting periods of underperformance, which might cause you to abandon a well-designed investment plan, try to lean into the outcome. Embrace it by considering that if positive premiums were absolutely certain, even over periods of 10 years or longer, you shouldn’t expect those premiums to materialize going forward. Why is this? Because in a well-functioning capital market, competition would drive down expected returns to the levels of other low-risk investments, such as short-term T-Bills. Risk and return are related.”

Would acceptance or resistance better describe your current portfolio and emotional state as an investor? If it’s resistance, what are you going to do to get closer to a state of acceptance to increase your odds of a successful investment experience?

Jesse Blom is a licensed investment advisor and Vice President ofLorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is aCERTIFIED FINANCIAL PLANNER™professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: