Last week Facebook (NASDAQ:FB) had the biggest one day drop of market cap in history for a single stock. It erased $120 billion in market value. Of course, the odds of a such a big move are pretty small, but the result can be devastating. We saw that with Facebook. As options traders, what can we learn from this event?

FB is one of the mostly watched stock in the US stock market. Many options traders try to play earnings using FB options.

There are few alternatives. We will backtest them using CMLviz Trade Machine.

1. Buying Call Options

This strategy involved buying call options on the day of the earnings announcement and selling them the next day. Here are the results:

This doesn't look so good. How about a bearish trade?

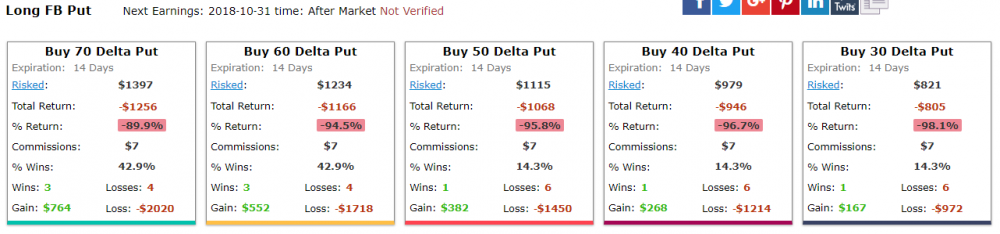

2. Buying Put Options

This strategy involved buying put options on the day of the earnings announcement and selling them the next day. Here are the results:

Looks much better. However, this result was heavily impacted by the last earnings release. You remove the gains from the last cycle, the strategy would be a loser as well.

How about buying a straddle (both calls and puts)?

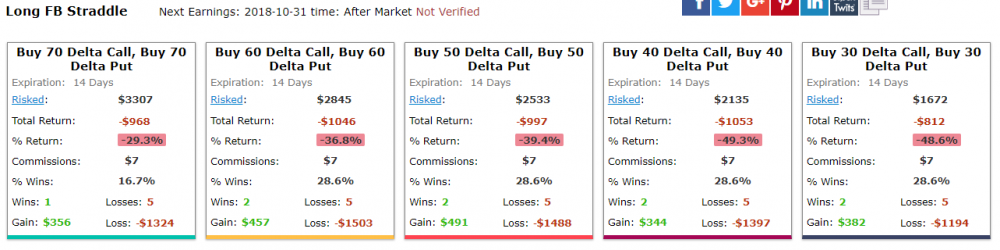

3. Buying a straddle

This strategy involved buying a straddle on the day of the earnings announcement and selling them the next day. Here are the results:

Once again, big chunk of the gains came from the last cycle when the stock tanked

20%. Removing the last cycle causes the overall return to become negative:

How about selling the straddle?

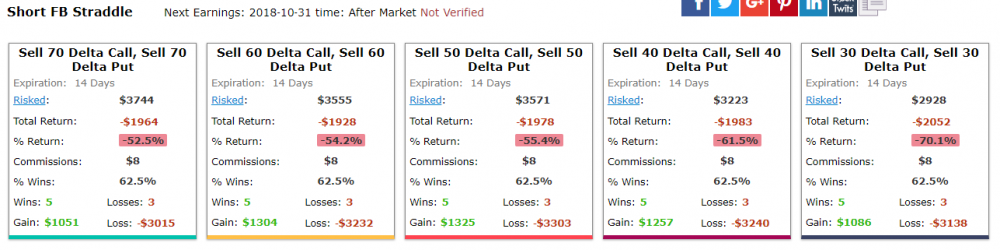

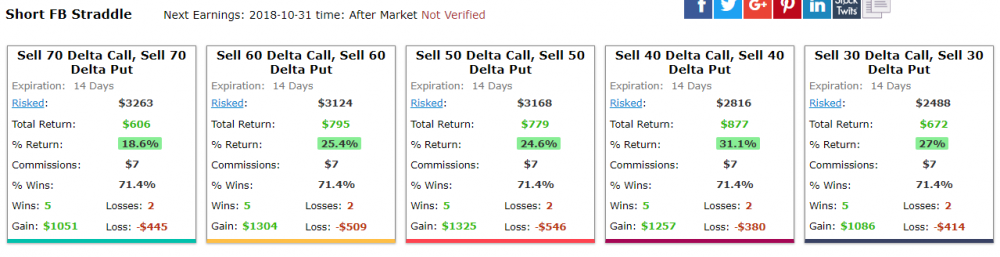

4. Selling a straddle

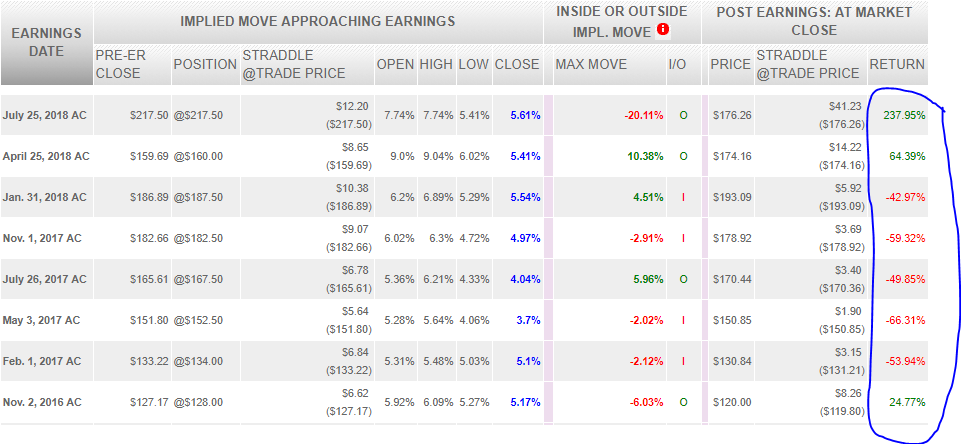

This strategy involved selling a straddle on the day of the earnings announcement and selling them the next day. Here are the results:

Overall loss - but again, ALL of the total loss came from the last cycle. If we remove the last cycle, the overall result becomes positive:

We performed the back testing using the CMLviz Trade Machine

Those backtests confirm what we already knew (more or less):

Buying straddles before earnings is on average a losing proposition

Chart from optionslam.com.

Based on those statistics, many options "gurus" suggest selling options

What they "forget" to mention (or maybe simply don't understand) is that high probability doesn't necessarily mean low risk.

Here is an excellent example used by our guest contributor Reel Ken:

We load a six-shooter gun with one deadly round and play Russian Roulette for $100 per trigger squeeze. The odds are 83% (5/6) that you win. Does that make it low-risk? What would low-risk look like? How about a 13-round Glock where your probability of success is over 90%. For certainly, if one defined risk as favorable odds, we would expect many takers, but I'll bet there wouldn't be any.

The reason is simple: One doesn't define risk by the probability of success. I often see this mistake when pundits promote investing strategies such as selling deep-out-of-the-money-puts (DOTM) on volatile stocks and lauding the low-risk-nature of the trade. "The stock would have to drop over x% (6%,7%, 10%) for you to lose". Well, Facebook reminded us of the real risk in such strategies.

Yes, risk isn't the chance of loss, it is the magnitude of potential loss

This confusion is because investors don't understand there is a completely other operative metric. They can easily put their hands around the potential loss and even recognize when a probability is very high or very low (I hope).

But probability isn't risk

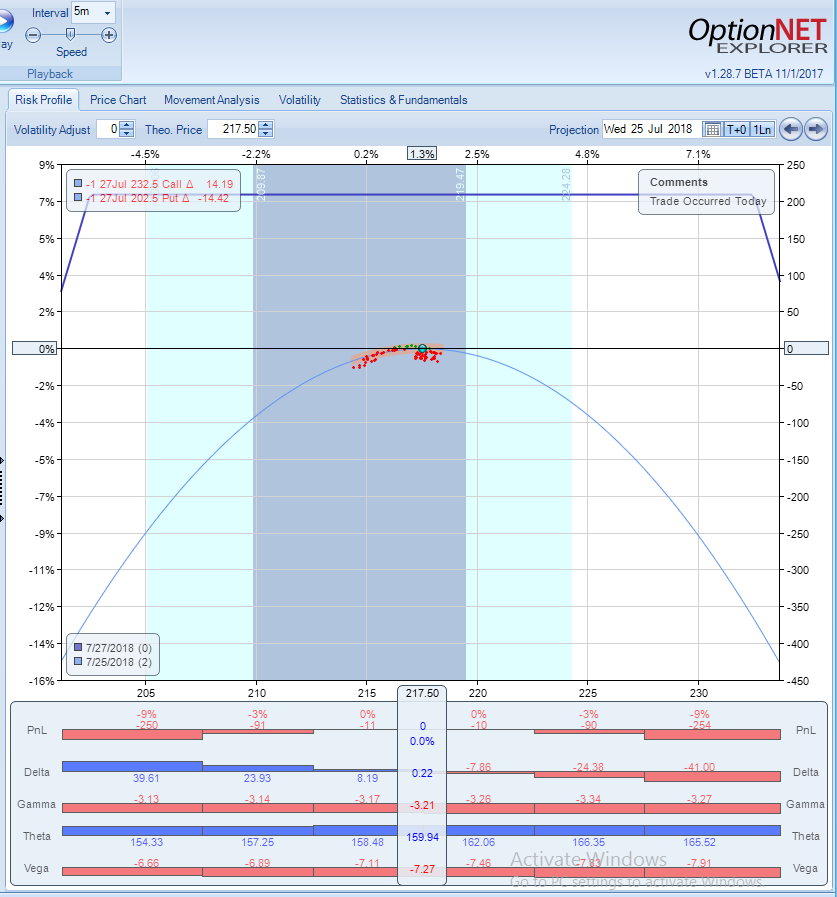

Lets check how this strategy would work for FB in the last cycle, by selling 1 SD strangle on the day of earnings. With the stock trading around $217, you would be selling 232.5 calls and $202.5 puts, for $208 credit. This is how P/L chart would look like:

The trade would tolerate around 7% move in each direction, which would work well most of the cycles

70% probability of success. Not bad.

As a side note, the trade would require around $2,850 margin, so even if you kept the whole credit, your return on margin would be around 7%.

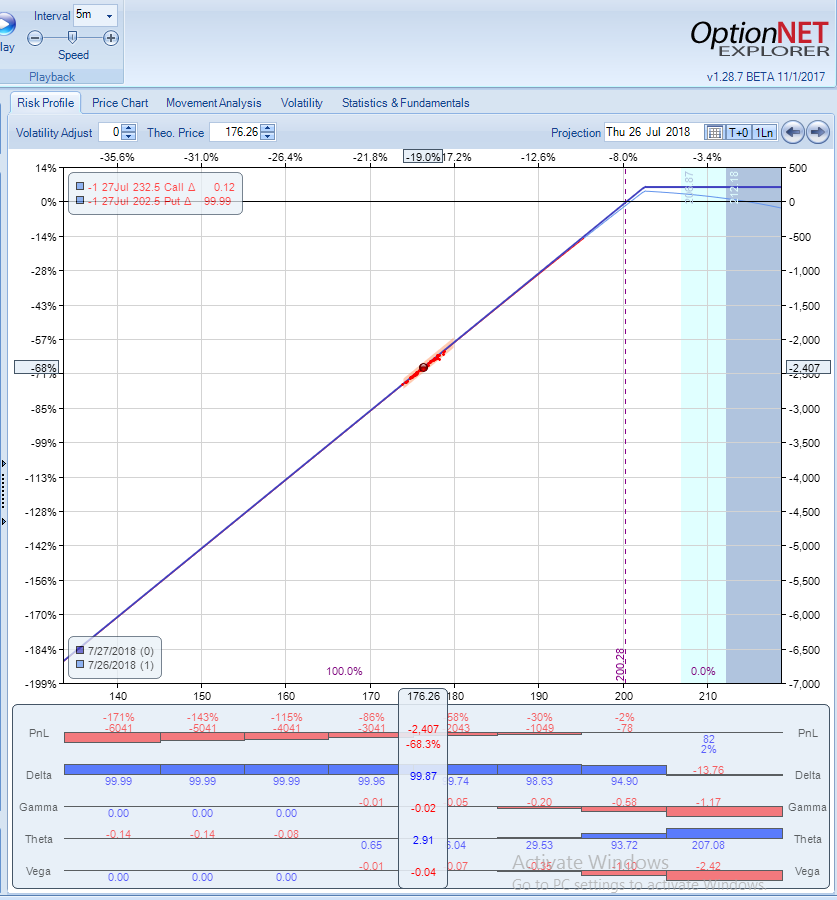

Fast forward to the next day after earnings have been announced and the stock was down almost 20%:

The trade was down a whopping $2,407, which would erase 12 months of gains (even if ALL previous trades were winners).

Conclusions

- Earnings are completely unpredictable. In order to make money from earnings trades held through the announcement, too many things have to go right and too many things can go wrong.

- Selling options around earnings have an edge on average for most stocks

- Don't confuse high probability with low risk. You can win 70-80% of the time, but you can also lose few times in a row. And when you lose, you can lose big time

- Those "one in a lifetime events" happen more often than you believe.

- Even if you did your homework and backtesting and decided to hold your trade through earnings, always assume a 100% loss and size your position accordingly.

- Even if the backtesting shows 90% winning ratio for a certain strategy, one huge move (in any direction) can erase months and months of gains.

The bottom line: trading options around earnings can be a very profitable strategy - but closing the positions before earnings will produce much more predictable and stable results with much less volatility.

"Trying to predict the future is like driving down a country road at night with no headlights on and looking out the back window." - Peter Drucker

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: