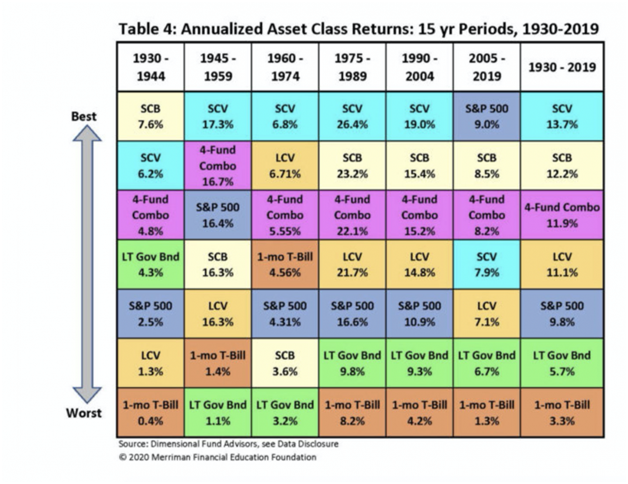

The best visual aids for learning are often very simple. The chart in this article was created by Paul Merriman, using data from Dimensional Fund Advisors. I primarily use Dimensional Funds in building portfolios for my clients. There are many takeaways from this chart, and I’d like to share a few thoughts that stick out most to me.

But first, a few definitions:

- “SCB”: Small Cap Blend. This represents an index of US small cap stocks

- “SCV”: Small Cap Value. This represents an index of US small cap value stocks

- “LCV”: Large Cap Value. This represents an index of US large cap value stocks

- “4-Fund Combo”: Equal weight S&P 500, LCV, SCB, and SCV

Academic theory suggests that markets are highly efficient at pricing asset classes so that risk and reward are related. When an asset class has more risk, it should also have a higher expected return. Otherwise why take the risk? Specifically, from lowest risk/reward to highest:

- 1-month T-bills (cash)…lowest risk, lowest expected return

- Long term government bonds

- Large cap stocks (S&P 500)

- Large cap value stocks

- Small cap stocks

- Small cap value stocks…highest risk, highest expected return

We see that the historical data matches the theory over the entire period. But certainly not over every 15-year period, which should be expected…otherwise there wouldn’t be risk if we knew with certainty that holding for 15 years would automatically produce a relative outcome of one asset classes versus another. Therefore, there is no period long enough where we can be certain of any outcome in markets. And for this reason

The diversification of the 4-fund combo never gives you the best outcome, which is a price to pay for also avoiding the worst outcome that you’re more likely concerned about. The period of 1960-1974 stands out, a period of 15 years where the popular S&P 500 index underperformed totally riskless 1-month T-bills (along with SCB & LT Gov Bonds). The 4-fund combo, due to the performance of value stocks, still produced a risk premium over T-bills.

Over the long-term, which is the only period an equity investor should care about, diversification can reduce worst case scenarios. Yet it’s interesting that when I review the portfolios of new clients and prospects, it’s extremely rare to find any allocation at all to small cap value stocks. Whether that portfolio was built with the help of an advisor or not hasn’t seemed to matter, indicating that lack of awareness of the historical data is the likely explanation. I’ve written extensively in other articles about the higher expected returns of small and value stocks, as this has been known for at least 30 years.

The last point I’ll make is that the same chart created with shorter periods, such as 1/5/10 year periods, has much more random outcomes. Again, this would be expected, and it’s why increasing your awareness of the range of potential outcomes over various time periods is one of the best things you can do to have proper expectations. My recent articles on market volatility digs deeper into this topic.

Conclusion

We should all attempt to judge the quality of every decision we make in our lives not solely based upon the after the fact outcome but based on the information we had available at the time of making the decision. With investments, this is especially true as we can only have historical data and academic theory to guide us. The science of investing is not like other forms of science where laws exist creating certainty of cause and effect outcomes . This means we should f ocus our attention on the things we can control such as diversification, asset allocation, and rebalancing. Once we’ve built our portfolios according to these principles, we can relax knowing that we’ve maximized our probability of having a successful investment experience.

Jesse Blom is a licensed investment advisor and Vice President ofLorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is aCERTIFIED FINANCIAL PLANNER™professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages theSteady Momentumservice.

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: