Few days ago I came across a Seeking Alpha article called Why I Never Trade Stock Options. This is probably one of the most misleading articles I have read in years. I would like to put things in perspective and provide a rebuttal to some of the claims in the article.

Mr. Marstrand who claims to be a financial professional with 15 years of experience in the investment bank industry, starts with the following paragraph:

"Free money with a few clicks using this Wall Street secret!" Who wouldn't want that? It's the sort of thing often claimed by options trading services. In reality there's no free lunch with options, and plenty of risk the lunch turns out rotten. So let me explain why I never trade stock options.

There are many dishonest trading services. Those claims are not unique to services who trade options. I do agree that there is no free lunch with options, but this is true for any style of investing or trading.

Mr. Marstrand continues with example of his friend "Bill" who worked for Swiss Bank Corporation. Bill had lost about $50 million of SBC's money the previous week trading stock options. Mr. Marstrand's conclusion?

He lost all that money despite him being a highly trained, full time, professional trader in the market leading bank in his business. I just want you to know that even the pros get burnt by stock options.

So? Warren Buffett has lost $4.3 billion in single day on Kraft Heinz plunge. What's the conclusion? Yes, even the pros lose money in the stock market. It's part of the game. But it has nothing to do with options. You can lose money trading stocks, ETFs, futures, commodities, options etc. Investing in a simple S&P 500 index fund would cause a 51% drawdown during the 2008 crisis. Does it mean you should stop investing in the stock market?

Here is Mr. Marstrand's next "gem":

All option strategies - even the supposedly low risk ones - have substantial risks which aren't always obvious. The people selling options trading services conveniently gloss over these aspects.

Well.. NO! This statement is simply false. Some option strategies are risky, but many of them are much safer than stocks. A strategy like collar limits your downside risk, and can be considered much safer than just holding the stock. Naked puts have higher margin of safety than stocks.

Of course if you treat options as lottery tickets, you have only yourself to blame.

And yes, SOME people who sell options trading services don't disclose the risks. But then again, if some people are dishonest, does it discredit the whole industry and the options trading in general?

Going to the next statement:

Oh, and it's a lot of work. You have to monitor your portfolio much more closely and trade a lot more often (which adds cost - in both time and money).

It could

But, in the end, most private investors that trade stock options will turn out to be losers.

Correct. Same is true for stock investors. Most investors lose money in the stock market. It has nothing to do with the vehicle they select. It is mostly related to human psychology and human emotions.

Consider this. If you buy or sell options through your broker, who do you think the counterparty is? Who is taking the other side of the trade? Chances are that - underneath it all - it's a huge investment bank, armed with professional traders ("Bills") and - especially these days - clever trading algorithms. And intermediaries like your broker will take their cut as well. Who do you think is getting the "right" price? Or better than right? It surely isn't you.

This statement is wrong on so many levels I don't even know where to start.

First, professional traders or algos don't always get it right. They are wrong many many times. In fact, most funds cannot even beat the market. But the same argument can be made about stock trading as well. If you buy a stock, you bet it will go up. The professional trader of the other side of the trade bets it will go down. According to Mr. Marstrand's logic, you have no chance against those guys.

Second, with options trading, it is likely that on the other side of the trade is a market maker and not some institutional trader. Market makers are obligated to provide liquidity in the options market, and there is a good chance that they will be on the other side of the trade.

Third (and probably the most important), any options trade can be part of a more complex strategy. If you buy a call, does it necessarily mean you bet on the stock to go up? It could be part of a neutral strategy like a straddle. And the guy who is selling you the call (if it's not a market maker), could be doing it as part of a covered call strategy. At the end, you both could be making money. This is why options are NOT Zero Sum Game.

Now to the final "gem":

As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy."

Are you seriously comparing options trading to poker Mr.Marstrand?

Options are such a wonderful tool if used properly. It offers great flexibility not only to speculate, but also to hedge, and much more.

As an example, over the past 25 years, the CBOE S&P 500 PutWrite Index (PUT) has outperformed the S&P 500 index, with lower volatility and better risk-adjusted returns. A simple strategy of writing fully collateralized naked puts on indexes, improved the sharpe ratio by over 30%.

Of course if all you do is buying some cheap OTM options as lottery tickets, you have only yourself to blame.

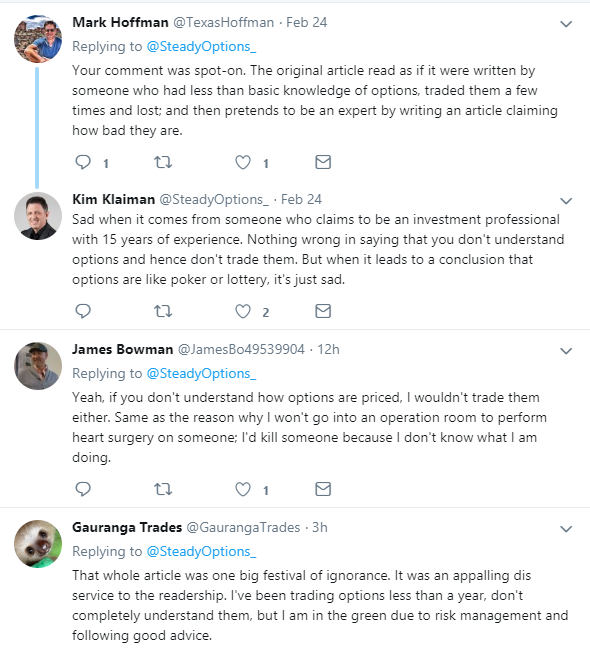

Twitter comments confirm that our followers know better:

One thing I do agree with Mr.Marstrand: if you want to trade options, be prepared to for a steep learning curve. As we tell our members, "learn first, trade later

Conclusion

The only dangerous part of options trading is the risk-insensitive trader who buys and sells options with little or no understanding of just what can go wrong. The options, by themselves, are not dangerous tools.

It is possible to use options to speculate (gamble), but options were created as hedging, or risk-reducing, investment tools.

An alarming number of financial professionals, including stockbrokers, financial planners and journalists are in position to educate the public about the many advantages to be gained from option strategies, but fail to do so. Many public investors never bother to make the effort to learn about options once they hear negative statements from professional advisors.

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: